Analytical Review Based On The Results Of A Closed Expert Survey Astana Open Dialogue "Trump’s Tariff Wars: How They Will Affect The Global Economy And The Economy Of Kazakhstan"

The closed survey was conducted from April 7 to April 13, 2025. The study involved more than 50 experts representing the fields of political science, economics, international relations, public administration, energy, education, journalism, and telecommunications. Among the respondents were representatives of a wide range of organizations: the Academy of Public Administration under the President of the Republic of Kazakhstan, the Kazakhstan Institute for Strategic Studies (KISI), MISP, the Center for the Study of Public Opinion, UNDP Kazakhstan, the Senate Office of the Parliament of the Republic of Kazakhstan, Narxoz University and others.

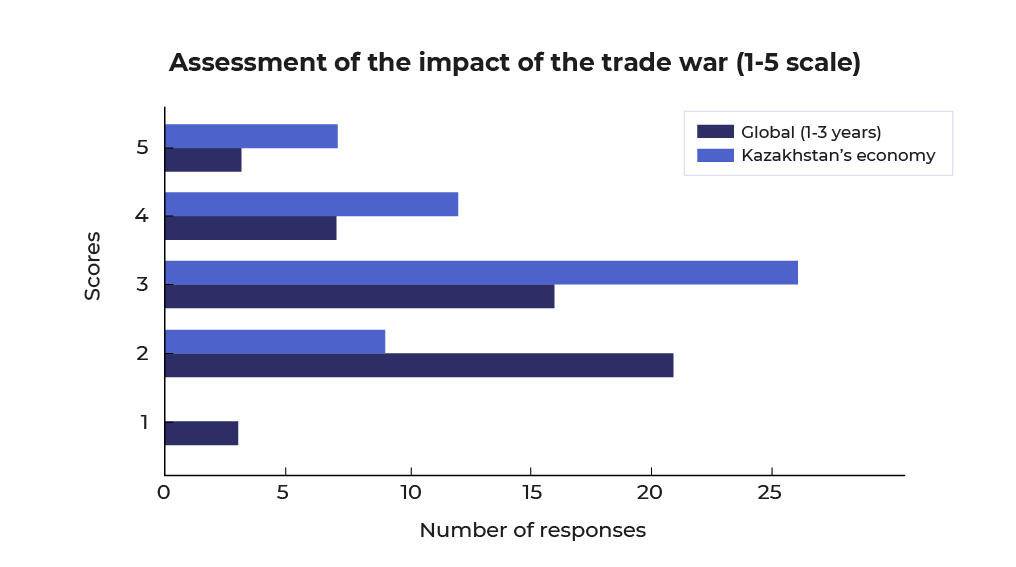

The survey methodology included a combination of point-based evaluation, multiple-choice questions, and open-ended comments. Experts were asked to assess the consequences of tariff escalation for global trade, the impact on Kazakhstan and Central Asia, as well as to propose possible response measures and structural reforms. The point-based questions used a scale from 1 to 5: respondents assessed the consequences of tariff escalation for global trade in the next 1–3 years (where 1 meant an extremely negative effect and 5 — a positive one), the depth of the impact of the US tariff conflicts on Kazakhstan’s economy (from 1 — no impact to 5 — significant impact), and the level of Kazakhstan’s readiness for the current trade turbulence (from 1 — complete unpreparedness to 5 — full readiness). The minimum score on all scales was 1 point, the maximum — 5 points, with each scale having a clear interpretation, reflecting the experts’ attitudes toward the aspects being assessed.

The closed survey was conducted from April 7 to April 13, 2025. The study involved more than 50 experts representing the fields of political science, economics, international relations, public administration, energy, education, journalism, and telecommunications. Among the respondents were representatives of a wide range of organizations: the Academy of Public Administration under the President of the Republic of Kazakhstan, the Kazakhstan Institute for Strategic Studies (KISI), MISP, the Center for the Study of Public Opinion, UNDP Kazakhstan, the Senate Office of the Parliament of the Republic of Kazakhstan, Narxoz University and others.

The survey methodology included a combination of point-based evaluation, multiple-choice questions, and open-ended comments. Experts were asked to assess the consequences of tariff escalation for global trade, the impact on Kazakhstan and Central Asia, as well as to propose possible response measures and structural reforms. The point-based questions used a scale from 1 to 5: respondents assessed the consequences of tariff escalation for global trade in the next 1–3 years (where 1 meant an extremely negative effect and 5 — a positive one), the depth of the impact of the US tariff conflicts on Kazakhstan’s economy (from 1 — no impact to 5 — significant impact), and the level of Kazakhstan’s readiness for the current trade turbulence (from 1 — complete unpreparedness to 5 — full readiness). The minimum score on all scales was 1 point, the maximum — 5 points, with each scale having a clear interpretation, reflecting the experts’ attitudes toward the aspects being assessed.

GENERAL ASSESSMENT OF THE SITUATION

In the short term (1–3 years), tariff escalation by the United States is assessed by the overwhelming majority of experts as a negative phenomenon. The average score on a scale from 1 to 5 was 2.7, with some respondents expressing extreme concern. The identified risks in this section are associated with the strengthening of protectionist tendencies and the disruption of established trade links. This conclusion is based both on the low scores and the mentioned threats of declining external demand and increased market access barriers.

In the short term (1–3 years), tariff escalation by the United States is assessed by the overwhelming majority of experts as a negative phenomenon. The average score on a scale from 1 to 5 was 2.7, with some respondents expressing extreme concern. The identified risks in this section are associated with the strengthening of protectionist tendencies and the disruption of established trade links. This conclusion is based both on the low scores and the mentioned threats of declining external demand and increased market access barriers.

Over a 3–5 year horizon, respondents forecast: an increase in trade conflicts and protectionism — 75%, a slowdown in global trade growth — 63.9%, and a strengthening of regional trade blocs — 50%. Against this backdrop, the risk lies in a shift from global open trade to fragmented economic zones. Such a shift will create limited room for maneuver for Kazakhstan, especially in the absence of active foreign economic policy, weak lobbying capacity, and export restrictions affecting entire sectors.

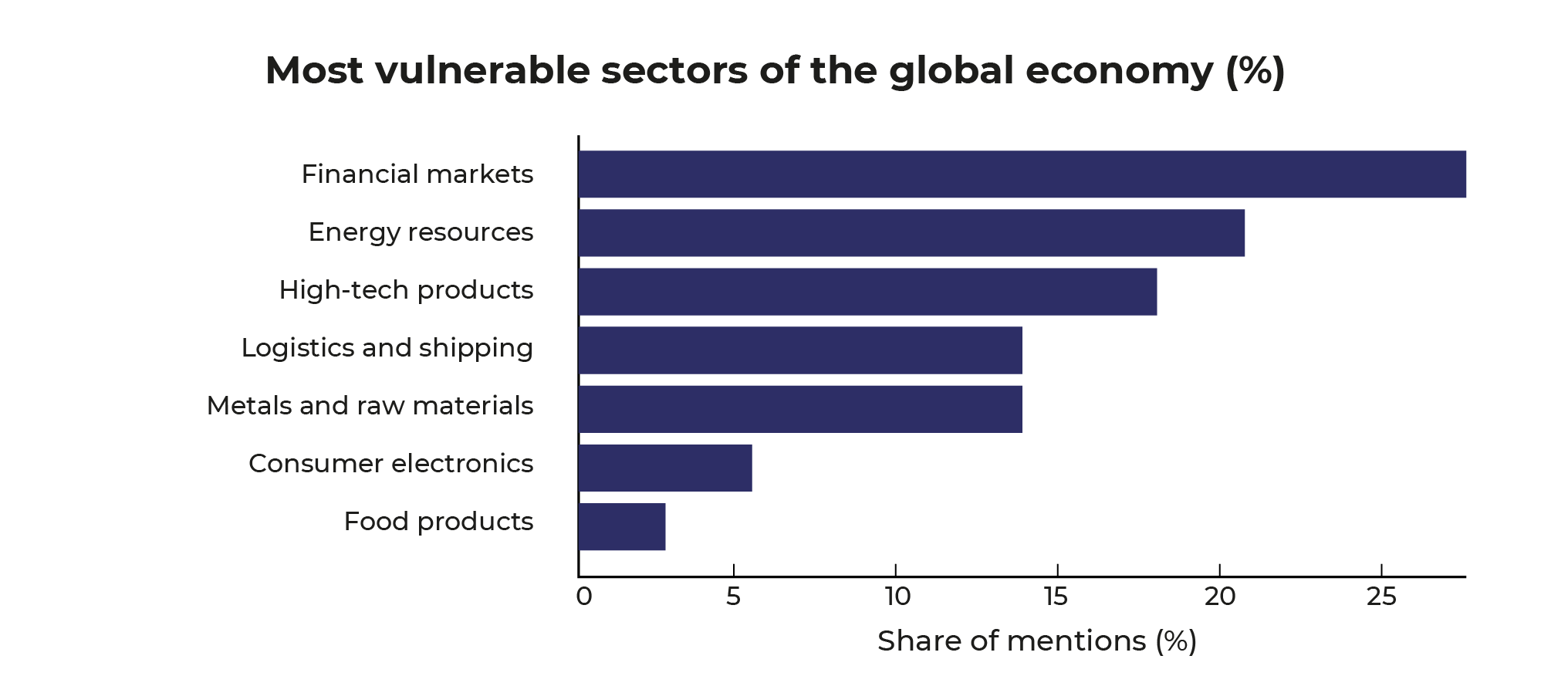

Speaking about vulnerable sectors of the global economy, experts almost unanimously point to high-tech products (61.1%), energy (50%), and financial markets (41.7%). This is due to the fact that these industries depend on complex and extended supply chains, which are the first to face restrictions. Thus, the risk of supply chain disruptions, increased logistics costs, and capital market instability logically follows from the nature of the selected sectors.

Speaking about vulnerable sectors of the global economy, experts almost unanimously point to high-tech products (61.1%), energy (50%), and financial markets (41.7%). This is due to the fact that these industries depend on complex and extended supply chains, which are the first to face restrictions. Thus, the risk of supply chain disruptions, increased logistics costs, and capital market instability logically follows from the nature of the selected sectors.

IMPACT ON KAZAKHSTAN AND CENTRAL ASIA

As for the impact on Kazakhstan, the assessments vary, but the average value is 3.2, which indicates a moderately strong degree of influence. The main threat, according to 83.3% of experts, is fluctuations in demand for raw materials. The second most significant factor is currency and investment risks (63.9%).

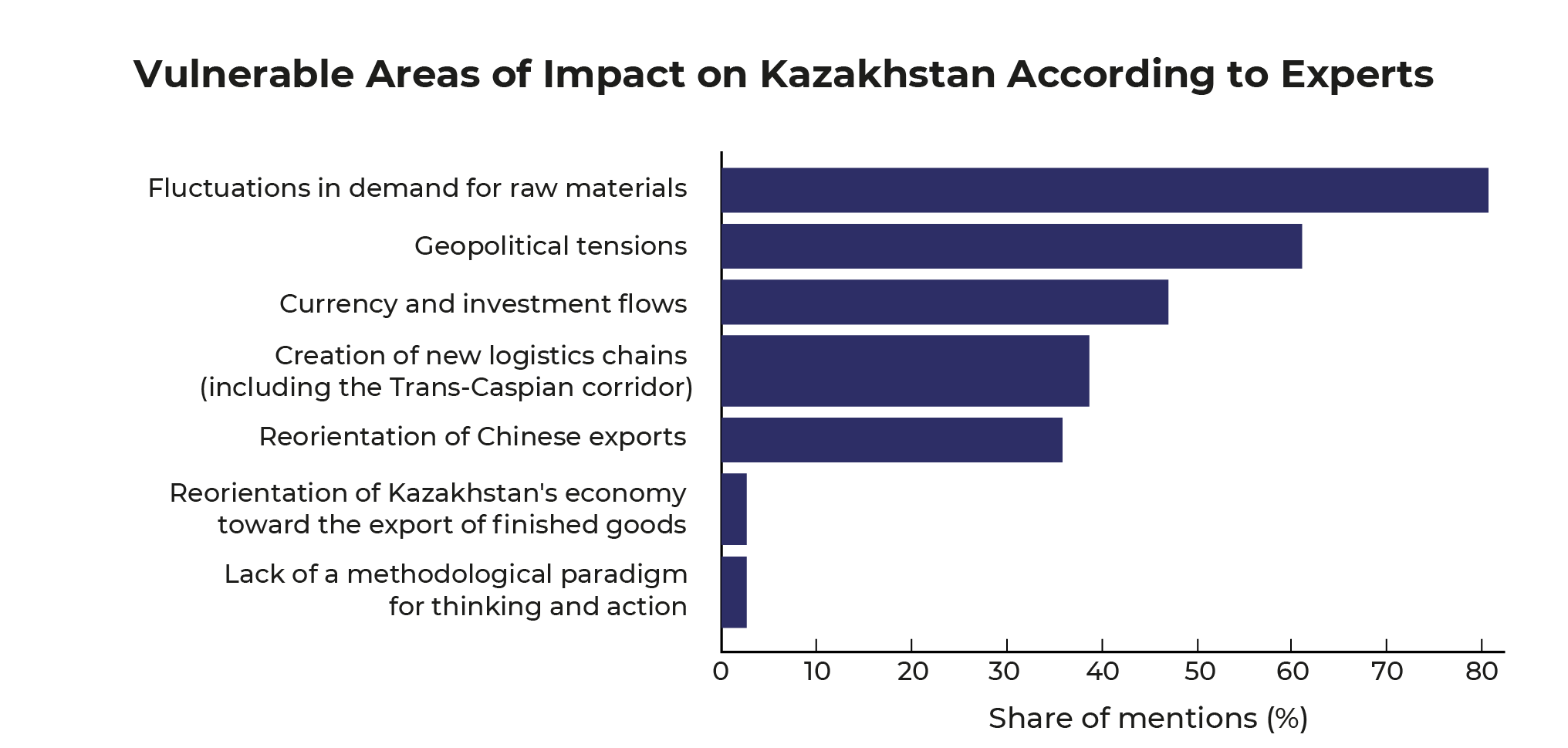

The most significant areas of impact of the trade war for Kazakhstan, according to experts, are fluctuations in demand for raw materials — this factor was noted by 80.6% of respondents, reflecting the country's high dependence on the export of raw materials. Geopolitical tensions ranked second (61.1%). The third most significant factor was currency and investment flows, noted by 47.2% of experts. Also mentioned were the creation of new logistics chains, including the Trans-Caspian corridor (38.9%), and the reorientation of Chinese exports (36.1%). Other options, such as reorientation to the export of finished products or the absence of a methodological paradigm, received isolated mentions (2.8% each).

As for the impact on Kazakhstan, the assessments vary, but the average value is 3.2, which indicates a moderately strong degree of influence. The main threat, according to 83.3% of experts, is fluctuations in demand for raw materials. The second most significant factor is currency and investment risks (63.9%).

The most significant areas of impact of the trade war for Kazakhstan, according to experts, are fluctuations in demand for raw materials — this factor was noted by 80.6% of respondents, reflecting the country's high dependence on the export of raw materials. Geopolitical tensions ranked second (61.1%). The third most significant factor was currency and investment flows, noted by 47.2% of experts. Also mentioned were the creation of new logistics chains, including the Trans-Caspian corridor (38.9%), and the reorientation of Chinese exports (36.1%). Other options, such as reorientation to the export of finished products or the absence of a methodological paradigm, received isolated mentions (2.8% each).

As for the consequences for Central Asia as a whole, expert opinions were distributed as follows: strengthening ties with China — 52.8%, participation in alternative logistics alliances — 50%, and an increase in Russia’s role as a transit partner — 41.7%. Also significant were such assessments as increased efforts toward economic autonomy (33.3%) and growing competition among countries in the region (30.6%). A few respondents pointed to such effects as deepening of internal integration processes, the gap between rich and poor countries, and economic decline. Kazakhstan (47.2%) and Kyrgyzstan (22.2%) were named as especially vulnerable, and 41.7% of responses indicated vulnerability of each Central Asian state.

The main challenge lies in the fact that Russia and China simultaneously serve as key markets for Kazakhstan and as major competitors in most commodity segments. Additionally, Russia remains the main transit corridor for Kazakhstan’s exports, which increases dependence on political agreements and highlights their strategic importance.

STRATEGIC ISSUES FOR KAZAKHSTAN

As for the necessary actions in the context of intensified global trade competition, experts identified several clear directions. The main emphasis is placed on stimulating domestic production and strengthening links in regional supply chains. Among the recommendations are the rejection of excessive regulation, especially in the export sphere, maintaining transparency in trade policy, and creating stable conditions for business. One of the survey participants formulated it as “Minimal export restrictions — no prohibitions”. Experts suggest that increased export revenue will allow exporters to offset external economic risks and maintain employment under unfavorable market conditions.

Another important step, according to experts, is the development of the industrial sector, especially in areas capable of integrating into global production chains.

"Kazakhstan should expand its trade relations with various countries, especially those not dependent on U.S. tariff policy. This may include strengthening trade with China, EU countries, and neighboring Central Asian states. Increased tariffs may raise the cost of imported goods. It is important to create incentives for the growth of local producers, including tax benefits, subsidies, or programs for small and medium-sized enterprises so they can compete with imports. In the event of a possible escalation of trade wars, it is important to strengthen the financial system, including measures to protect the national currency and maintain currency reserves. This also includes minimizing inflation risks, especially in the context of possible changes in commodity prices."

Taken together, these recommendations shape a direction for a government strategy focused on industrialization, tax and institutional incentives, and minimizing regulation of foreign economic activity.

Regarding Kazakhstan’s potential to benefit from the redistribution of global trade flows, opinions are divided. 44.4% consider such a scenario realistic, provided that neutrality, geographic position, and favorable logistics are effectively utilized.

"Potential advantages are associated with the strengthening of the country’s transit role, especially through the development of the Trans-Caspian International Transport Route, which is becoming increasingly in demand amid geopolitical constraints and the desire to reduce dependence on traditional routes through Russia. In addition, Kazakhstan can attract investment into logistics and transport infrastructure, acting as a stable partner between East and West. There are also opportunities for the growth of manufacturing, agro-exports, and digital services, which allow the country to integrate into new, diversified supply chains. Success will depend on the ability to quickly adapt to changes, coordinate with neighbors, and create attractive conditions for international business."

However, 38.9% of experts assess the country’s potential with skepticism. Nevertheless, supporters of the positive position are confident that in the context of the new global architecture, Kazakhstan can become a stable economic hub. By analogy with the situation of sanctions pressure on Russia, Kazakhstan has the opportunity to develop parallel imports and re-exports of goods. Although on a global scale the resale volumes at the level of 3–4 billion USD per year remain insignificant, for the national economy this amount is substantial. The realization of such potential requires not only non-interference through restrictive measures, but also the active development of warehouse infrastructure.

The analysis of responses to the question of which instruments could enhance Kazakhstan’s attractiveness as a manufacturing platform in the context of the new global configuration demonstrates a diversity of expert expectations. A number of survey participants point to the need to create a favorable tax regime and simplify business conditions. Others emphasize the importance of administrative competence and impartial regulation. Some respondents associate the potential with the country’s resource advantages, such as the availability of raw materials and rare earth metals. At the same time, several participants expressed doubts that Kazakhstan is capable of becoming an attractive production center in the foreseeable future. Taken together, the responses show that the key expectations are linked to the creation of a predictable, competitive institutional environment, but also reveal a degree of skepticism about the state’s readiness to implement these conditions systematically and in the interest of business.

“To increase Kazakhstan’s attractiveness as a manufacturing platform in the new global configuration, the government should more actively use the mechanisms of special economic zones with tax and customs incentives, rapidly develop transport and logistics infrastructure, and improve the investment climate through guarantees of investor protection and transparent legislation. It is important to develop vocational education to ensure a qualified workforce. Additionally, administrative procedures should be simplified and digital platforms for business support introduced, which will significantly increase competitiveness and attract new foreign partners.”

The responses to the question of how Kazakhstan should act within the EAEU, SCO, OIC, and other multilateral platforms demonstrate a wide range of strategic approaches. 25% of respondents offered proposals including restrained activity within international structures, which was formulated as “continuation of the current foreign policy.” At the same time, 27.8% of experts advocated for a proactive role of Kazakhstan, emphasizing the need for more active positioning of the country in international negotiations. 19.4% of respondents supported a facilitation and coordination role for Kazakhstan.

“In connection with Trump’s protectionist tariff policy, many manufacturing companies have begun to look for alternative locations outside of China. This opens up opportunities for countries like Kazakhstan to offer favorable conditions for production relocation. However, in order to take advantage of this opportunity, the country must adapt its tariff and tax policy to attract investors. It is also important to ensure transparency of foreign trade procedures and minimize border barriers. Kazakhstan can position itself as a neutral and stable partner against the backdrop of global trade tensions.”

CONCLUSION

On the issue of long-term risks and opportunities, experts outlined two scenarios:

1) The pessimistic scenario assumes a decline in raw material prices, increased dependence on imports, and growing external vulnerability of Kazakhstan;

2) The optimistic scenario, on the contrary, is associated with export liberalization, active foreign policy, the organization of goods re-export, the possibility of strengthening regional cooperation, and the development of domestic industries, including processing and the agricultural sector.

The key factor in the implementation of the positive scenario remains an active and systematic domestic policy. The average score of Kazakhstan's readiness for the current trade turbulence amounted to 2.2 points. At the same time, 30.6% of experts gave the lowest score of 1, 33.3% — 2, another 30.6% — 3, and only 5.6% gave a score of 4 or 5. This indicates a general perception of the country as insufficiently prepared for a large-scale restructuring of the global economy.

In terms of structural reforms, the most frequently mentioned were: the development of transport infrastructure, aligning the exchange rate with its real value, public administration reform, and the establishment of priorities in planning.

The main challenge lies in the fact that Russia and China simultaneously serve as key markets for Kazakhstan and as major competitors in most commodity segments. Additionally, Russia remains the main transit corridor for Kazakhstan’s exports, which increases dependence on political agreements and highlights their strategic importance.

STRATEGIC ISSUES FOR KAZAKHSTAN

As for the necessary actions in the context of intensified global trade competition, experts identified several clear directions. The main emphasis is placed on stimulating domestic production and strengthening links in regional supply chains. Among the recommendations are the rejection of excessive regulation, especially in the export sphere, maintaining transparency in trade policy, and creating stable conditions for business. One of the survey participants formulated it as “Minimal export restrictions — no prohibitions”. Experts suggest that increased export revenue will allow exporters to offset external economic risks and maintain employment under unfavorable market conditions.

Another important step, according to experts, is the development of the industrial sector, especially in areas capable of integrating into global production chains.

"Kazakhstan should expand its trade relations with various countries, especially those not dependent on U.S. tariff policy. This may include strengthening trade with China, EU countries, and neighboring Central Asian states. Increased tariffs may raise the cost of imported goods. It is important to create incentives for the growth of local producers, including tax benefits, subsidies, or programs for small and medium-sized enterprises so they can compete with imports. In the event of a possible escalation of trade wars, it is important to strengthen the financial system, including measures to protect the national currency and maintain currency reserves. This also includes minimizing inflation risks, especially in the context of possible changes in commodity prices."

Taken together, these recommendations shape a direction for a government strategy focused on industrialization, tax and institutional incentives, and minimizing regulation of foreign economic activity.

Regarding Kazakhstan’s potential to benefit from the redistribution of global trade flows, opinions are divided. 44.4% consider such a scenario realistic, provided that neutrality, geographic position, and favorable logistics are effectively utilized.

"Potential advantages are associated with the strengthening of the country’s transit role, especially through the development of the Trans-Caspian International Transport Route, which is becoming increasingly in demand amid geopolitical constraints and the desire to reduce dependence on traditional routes through Russia. In addition, Kazakhstan can attract investment into logistics and transport infrastructure, acting as a stable partner between East and West. There are also opportunities for the growth of manufacturing, agro-exports, and digital services, which allow the country to integrate into new, diversified supply chains. Success will depend on the ability to quickly adapt to changes, coordinate with neighbors, and create attractive conditions for international business."

However, 38.9% of experts assess the country’s potential with skepticism. Nevertheless, supporters of the positive position are confident that in the context of the new global architecture, Kazakhstan can become a stable economic hub. By analogy with the situation of sanctions pressure on Russia, Kazakhstan has the opportunity to develop parallel imports and re-exports of goods. Although on a global scale the resale volumes at the level of 3–4 billion USD per year remain insignificant, for the national economy this amount is substantial. The realization of such potential requires not only non-interference through restrictive measures, but also the active development of warehouse infrastructure.

The analysis of responses to the question of which instruments could enhance Kazakhstan’s attractiveness as a manufacturing platform in the context of the new global configuration demonstrates a diversity of expert expectations. A number of survey participants point to the need to create a favorable tax regime and simplify business conditions. Others emphasize the importance of administrative competence and impartial regulation. Some respondents associate the potential with the country’s resource advantages, such as the availability of raw materials and rare earth metals. At the same time, several participants expressed doubts that Kazakhstan is capable of becoming an attractive production center in the foreseeable future. Taken together, the responses show that the key expectations are linked to the creation of a predictable, competitive institutional environment, but also reveal a degree of skepticism about the state’s readiness to implement these conditions systematically and in the interest of business.

“To increase Kazakhstan’s attractiveness as a manufacturing platform in the new global configuration, the government should more actively use the mechanisms of special economic zones with tax and customs incentives, rapidly develop transport and logistics infrastructure, and improve the investment climate through guarantees of investor protection and transparent legislation. It is important to develop vocational education to ensure a qualified workforce. Additionally, administrative procedures should be simplified and digital platforms for business support introduced, which will significantly increase competitiveness and attract new foreign partners.”

The responses to the question of how Kazakhstan should act within the EAEU, SCO, OIC, and other multilateral platforms demonstrate a wide range of strategic approaches. 25% of respondents offered proposals including restrained activity within international structures, which was formulated as “continuation of the current foreign policy.” At the same time, 27.8% of experts advocated for a proactive role of Kazakhstan, emphasizing the need for more active positioning of the country in international negotiations. 19.4% of respondents supported a facilitation and coordination role for Kazakhstan.

“In connection with Trump’s protectionist tariff policy, many manufacturing companies have begun to look for alternative locations outside of China. This opens up opportunities for countries like Kazakhstan to offer favorable conditions for production relocation. However, in order to take advantage of this opportunity, the country must adapt its tariff and tax policy to attract investors. It is also important to ensure transparency of foreign trade procedures and minimize border barriers. Kazakhstan can position itself as a neutral and stable partner against the backdrop of global trade tensions.”

CONCLUSION

On the issue of long-term risks and opportunities, experts outlined two scenarios:

1) The pessimistic scenario assumes a decline in raw material prices, increased dependence on imports, and growing external vulnerability of Kazakhstan;

2) The optimistic scenario, on the contrary, is associated with export liberalization, active foreign policy, the organization of goods re-export, the possibility of strengthening regional cooperation, and the development of domestic industries, including processing and the agricultural sector.

The key factor in the implementation of the positive scenario remains an active and systematic domestic policy. The average score of Kazakhstan's readiness for the current trade turbulence amounted to 2.2 points. At the same time, 30.6% of experts gave the lowest score of 1, 33.3% — 2, another 30.6% — 3, and only 5.6% gave a score of 4 or 5. This indicates a general perception of the country as insufficiently prepared for a large-scale restructuring of the global economy.

In terms of structural reforms, the most frequently mentioned were: the development of transport infrastructure, aligning the exchange rate with its real value, public administration reform, and the establishment of priorities in planning.